Top 10 Proven Ways to Teach Your Child Financial Responsibility

Table of Contents

Welcome, Parents! How to teach your child financial responsibility is a crucial skill that every parent should impart. Here are the top 10 ways to ensure your child grows up with a solid understanding of managing money.If you’re looking to instill a sense of financial responsibility in your children, you’ve found the perfect resource. Teaching kids about money management from a young age is crucial for their long-term success and independence. This guide provides you with the top 10 effective strategies to make your children financially savvy. Stick with us, and you’ll discover actionable steps that can be easily implemented into your daily parenting routine!

Understanding How To Teach Your Child Financial Responsibility

Before we dive into the specific strategies, let’s understand what financial responsibility really means for a child. It involves learning how to manage money wisely—earning, saving, spending, and even investing. For children, the foundation of financial responsibility is understanding the value of money and the consequences of financial decisions.

1. Start with the Basics: Earning and Saving

Allowances and Chores

Linking chores to an allowance is a practical method to teach children that money is earned and not merely given. This system instills a work ethic and the fundamental principle that effort leads to rewards. You could create a chart listing different chores with corresponding pay rates, helping your child decide which tasks they can take on to earn their allowance. This method teaches accountability and responsibility from an early age.

Save Before Spending

It’s crucial to teach children to save a portion of their money before thinking about spending it. You might introduce the concept of “paying yourself first,” a basic saving principle. Encourage them to decide on a percentage of their allowance to save regularly. This habit, started early, will help them build financial cushioning and prepare them for managing larger sums as they grow.

2. Budgeting Basics

Create a Simple Budget

Helping your child to create a simple budget that tracks their allowance and spending is a key step in learning how to teach your child financial responsibility. This can be a fun and educational activity. Use jars, envelopes, or even digital apps designed for young savers to categorize and store money. Categories can include ‘savings,’ ‘spending,’ and ‘sharing.’ This visual and physical separation of money helps children understand budgeting basics and encourages a balanced approach to managing their funds, which is essential in teaching financial responsibility effectively.

Set Savings Goals

Work with your child to set realistic savings goals. These could range from smaller items like a new video game or toy to larger goals such as saving for a school trip. Discuss how much money they need to save and how long it might take them to achieve their goal based on their allowance and saving rate. This practice teaches them about delayed gratification and planning ahead, essential aspects of financial responsibility.

3. The Power of Wise Spending

Smart Shopping Decisions

Teach children to make smart shopping decisions by comparing prices and seeking the best value for money. Explain that sometimes, a more expensive item might be a better choice because it’s higher quality and will last longer. Help them understand the trade-offs and benefits of comparison shopping by reviewing different products together and discussing their features and benefits.

Understanding Needs vs. Wants

Distinguishing between needs and wants is a critical financial lesson when learning how to teach your child financial responsibility. Needs are essentials, such as food and clothing, while wants are items that are nice to have but not necessary. Help your child categorize their desires and prioritize their spending accordingly. This lesson is fundamental in avoiding impulse buying and encouraging thoughtful spending.

4. Introduce Them to Banking

Open a Savings Account

Introduce your child to the concept of a savings account. Many banks offer accounts specifically for children and teens, which often come with no fees and teach them about the benefits of earning interest. Explain how money in the bank can grow over time, providing them with more resources in the future.

Regular Bank Visits

Make regular visits to the bank or use online banking to show your child their account balance and track their progress toward savings goals. This regular check-in reinforces the concept of saving and helps them make the connection between saving money and seeing it grow through interest.

5. The Concept of Investing

Simple Investments

When learning how to teach your child financial responsibility is important to siscuss basic investment concepts such as bonds or stocks. Use real-world examples or stories to illustrate how investing works and how money can grow. Explain the difference between saving (putting money in a bank) and investing (using money to make more money).

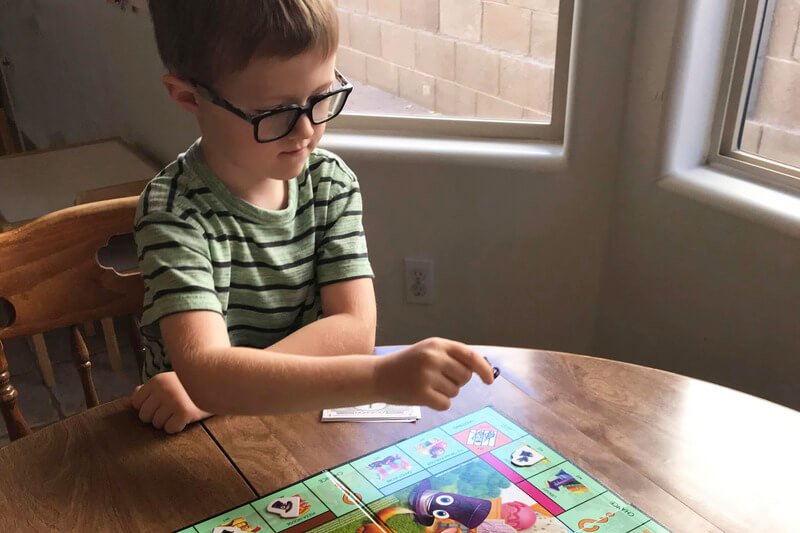

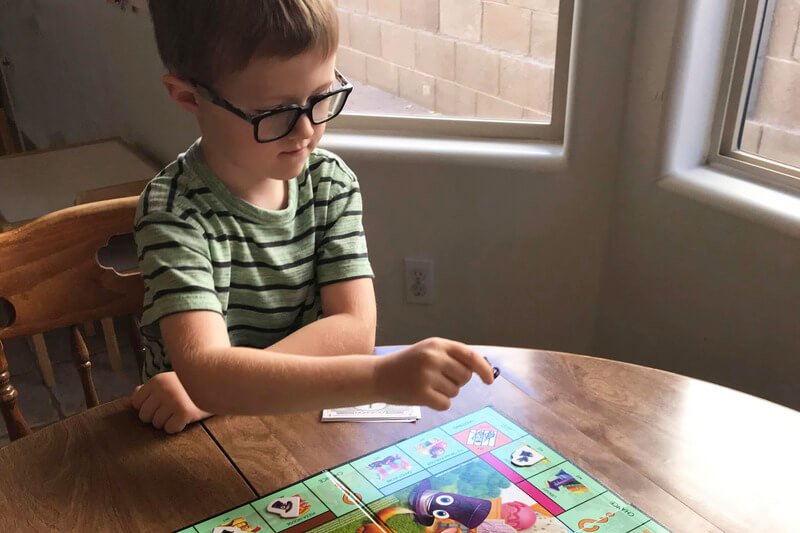

Games and Simulations

Utilize board games when learning how to teach your child financial responsibility like Monopoly or online simulators that teach business and investment fundamentals. These games make learning about investments fun and engaging, providing practical experience in a risk-free environment.

6. Credit and Loans

Borrowing for a Purpose

Explain how credit works and emphasize the importance of borrowing only what one can repay. Discuss different scenarios where borrowing might be necessary (like buying a house) and differentiate them from unnecessary debt.

Interest Rates and Debt

Use simple examples to show how interest accumulates on borrowed money and the consequences of not managing debt wisely. You might illustrate this by comparing how much more an item costs when bought with credit versus saved cash.

7. Charitable Giving

The Joy of Giving

Encourage your child to set aside a small part of their savings for charity. This not only teaches them about the importance of helping others but also introduces them to the concept of philanthropy as a financial responsibility.

Volunteer Together

Participating in community services or charity events as a family is also important when learning how to teach your child about financial responsibility. This shows your child the impact of giving back and helps instill a sense of community and compassion.

8. Long-Term Financial Planning

Future Financial Goals

Discuss long-term financial goals like saving for college or buying a car. Teach them about the different saving and investment strategies that can help achieve these goals.

Family Budget Meetings

Include your child in family budget discussions to give them a broader perspective on financial planning and management. This can be a monthly or quarterly review where you discuss expenses, savings, and future financial needs.

9. Financial Responsibility in the Digital Age

Online Banking and Safety

Teach them about the security aspects of using digital banking, emphasizing the importance of keeping passwords confidential and recognizing phishing scams.

Digital Wallets and Apps

Introduce them to budgeting and savings apps like Yuby, An app designed to teaching kids about money and help them understand financial concepts by making virtual financial decisions. These apps can make managing money more interactive and relatable to young users.

Organizations teaching kids about money like JumpStart Coalition for Personal Financial Literacy a nonprofit focuses on improving financial literacy at the K-12 level and offers a variety of resources for teaching financial literacy to children.

10. Regular Financial Check-ins

Review and Reflect

Have regular sit-downs with your child to discuss what they’ve learned about money, any adjustments in their budgets, or progress towards their savings goals. This ongoing dialogue ensures that they stay on track and adapt their learning to new financial challenges.

Adapt and Educate

As your child grows, continuously update the financial lessons to include more complex topics like taxes, insurance, and retirement savings. This ensures that their financial education grows with their needs and age.

By expanding on these points, you provide a comprehensive roadmap for parents looking to instill financial wisdom in their children, paving the way for their future financial independence and success.

Conclusion: Empowering Your Child with Financial Knowledge

Teaching your child financial responsibility is one of the most valuable life skills you can offer. It prepares them for real-world challenges and helps them make informed decisions. By starting these lessons early, you’re setting your child up for a lifetime of financial success and independence.

Are you ready to take the next step in guiding your child towards financial savvy? Share your thoughts, visit our page for more resources, or download our free guide on financial education for kids. Join the community of proactive parents who are empowering their children with essential financial knowledge today!

Responses